What's the most important thing in life? Give yourself full marks if you said "status". This is why I was so alarmed when I recently came across statistics about average account sizes at Burgundy Asset Management, a firm I previously associated with blue-blood, properly wealthy Canadians. Like the billionaire Jackman family.

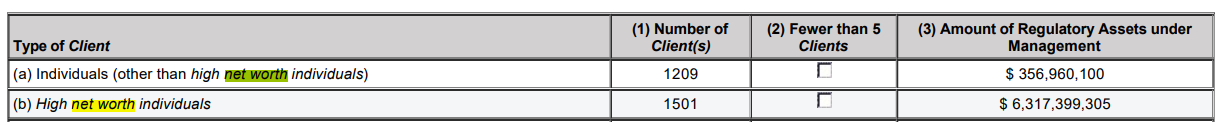

According to one official company report I have seen, Burgundy has 1,501 HNW clients holding an average of $5m each. HNW is defined as someone above $2m in net worth. Burgundy then has 1,209 clients who are known as MWSAs who have about $375k each, on average. MWSA is defined as Muppets With Small Accounts. I don't know if such divisive language is necessary.

Check the math for yourselves: (the asset amounts are USD)

After a weeks-long investigation, OPM Wire can now reveal the likely origin of this Low Net Worth contamination. Burgundy was started in 1991 and within a few years experienced tremendous growth and became a well-established firm catering to institutions and the truly wealthy. In 2004, a Burgundy executive by the name of Rob Barbara, son of their original biz dev guy Lloyd Barbara, came up with the heretic idea of creating a low-status division, called Beaujolais Private Investment Management. OPM Wire has learned that Beaujolais was prepared to accept amounts as unprestigious as $500k. Many people don't know this, but Beaujolais is French for "Muppets With Small Accounts". So hurtful. Rob Barbara left in 2013 and now lives in Atlantic Canada, in keeping with his obvious lack of status awareness.

From the beginning, there was little to distinguish Burgundy from Beaujolais. A Burgundy client could, at the right size, have separately managed accounts. Beaujolais clients were always put in pooled funds. Aside from that, Beaujolais was little more than a trademark. Like the Marc line by Marc Jacobs, if you know something about handbags. I also get the impression Beaujolais never reached a meaningful enough scale. So in 2018, in a catastrophic management decision, rather than divesting Beaujolais to an appropriate suitor like Wealthsimple, Winners or Dollarama, Burgundy folded it in. The two operations were fully merged. Today, Burgundy is Beaujolais and Beaujolais is Burgundy. I have tried to ascertain whether Burgundy has taken some steps to mitigate this forced marriage, such as building separate meeting facilities and washrooms for the riffraff. According to multiple sources with weak bladders, the answer is no. I want to puke.

When Beaujolais was started in 2004, Burgundy's minimum was $3m. At the time, the average Toronto home cost about $300k. Today, the average home has gone up to $1 million and yet Burgundy's own minimum has gone down to $1 million. What caused this alarming regression? Don't get me wrong, I think it's OK to accommodate small seven figure accounts if a client wants to teach a child about investing or what it's like to live with limited means...but Burgundy is opening 6-figure accounts? I am sorry, it's just not done.

I should add, before I get in trouble, that wealth, in my view, is neither necessary nor, by itself, a sufficient condition for high status. But come on. A six-figure net worth in the Golden Age of Asset Inflation? Please be serious. I have shoes that I forgot to throw out that are worth more. #neversell. You have to wonder: what sort of low-status move are they going to pull next? Start a division called Dijon to cater to TFSAs? Launch a robo-advisor called Hamburger Helper? I am sorry but when it comes to status, Burgundy no longer cuts the mustard.

Make no mistake: this is the biggest Canadian business scoop since the Ben Johnson doping scandal. There's also an argument for the regulator to be involved. Tony Arrell can't go around wearing a bow-tie and pretending to enjoy the opera if, at the same time, his firm is welcoming barefoot pilgrims as clients. It was all a big smokescreen. Next time you go to a Burgundy function at the Royal Ontario Museum or whatever, remember: there's a material risk you might unknowingly find yourself mingling with a Dull Normal working stiff, like an orthodontist. Tony claims to have small-town values, but does this give him the right to carry out some deranged experiment where different socioeconomic stratas mix together unnaturally? Outrageous!

This might sound banal, but I really feel things have never been more difficult for rich people. Muppet-friendly tools like low-fee passive ETFs have clobbered the returns of more "sophisticated" funds for the past 10 years. Rank speculation by Robinhood yolotraders is being rewarded, for now. At many firms on the high-end, clients have little to brag about at cocktail parties, performance-wise. Just two days ago, I read about a wealthy Toronto couple who made more money opening a bakery than investing in a hedge fund firm. What’s going on? And then you have the indignities I have just revealed at Burgundy. You are left to wonder: Who can I trust to validate my high standing in the social dominance hierarchy? I understand your pain and confusion. I pledge to you that OPM, for one, will always remain a Super Premium High Prestige brand. If I ever want to work on the financial problems of the hoi polloi, rest assured I would operate a completely different brand with leased porta-potties. I'd call it Magic Bullet Huge $$$ Through Deep Research. The muppets would totally fall for that.